Choose the right investment pool to grow your funds

Nonprofits and individuals can select an investment pool that best serves their goals, including the risk profile and timeline of usage, as a means of growing idle cash over time.

The Catholic Community Foundation and its partner, BNY Mellon, have constructed investment pools designed to provide a variety of risk and return profiles. The BNY Mellon team actively manages these pools and seeks to manage risk and return efficiently and effectively.

The pools comply with USCCB investment guidelines and are actively monitored, screened, and evaluated by the Foundation’s Finance and Investment Committee. You can have peace of mind knowing that qualified professionals constantly review the portfolio's activity and holdings.

These investment options are for individuals with a traditional Donor-Advised fund account or nonprofit organizations with a Catholic Growth Fund. The pools are listed in order of highest to lowest risk. Before choosing an option, we recommend a free consultation with our investment partner to understand your risk profile better and what option is most appropriate for your situation.

Our investment pools house all of the fund types we offer:

Endowments

Donor-advised Funds

Brokerage Accounts

Quasi-Endowments

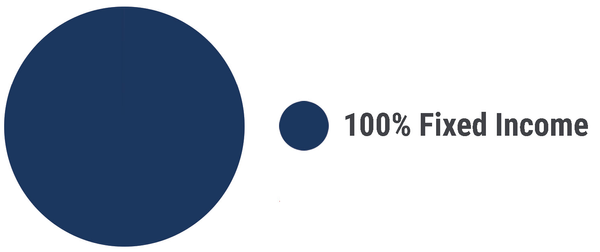

Fixed Income Pool

- Time horizon for fund use: 0-3 years

- Investor type: An investor has a known use for funds in the near future and desires a yield better than cash

- Risk rating: 1 out of 5 (low risk)

Investment Fee: 0.30%

The overall pool's investment objective is income. The primary goal is to provide a consistent stream of current income. The portfolio invests primarily in fixed-income assets with a focus on yield. Current income is expected to be the primary source of return for this portfolio. The portfolio may, at times, invest a small portion of assets in equities as an inflation hedge. This portfolio is anticipated to have a low to moderate level of volatility due to fluctuations in interest rates and equity valuations.

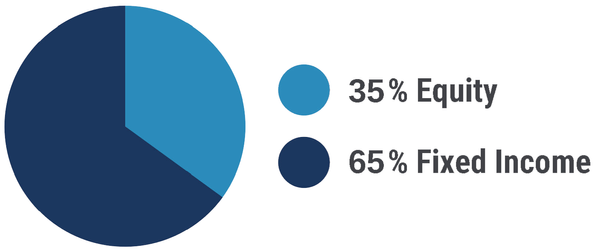

Capital Preservation Pool

- Time horizon for fund use: 2-5 years

- Investor type: An investor has a known use for funds in the future and desires a yield better than cash plus inflation and can tolerate mild volatility

- Risk rating: 2 out of 5 (low to moderate risk)

- Investment Fee: 0.34%

The investment objective for the overall relationship is moderate income. The primary goal is to generate current income with some principal growth while limiting the risk of loss through a derivative instrument called a structured note.

While most of the investments will be fixed-income assets, a mix of equities will be included for modest growth potential and an inflation hedge. A modest allocation to alternative investments will also benefit diversification and may help mitigate some volatility. This portfolio is anticipated to have a low to moderate level of volatility due to fluctuations in interest rates and equity valuations.

2025 - 2026 Monthly Flash Reports: Capital Preservation Pool

- CCF Flash Report Capital Pres - 1.31.26.pdf

- CCF Flash Report Capital Pres - 12.31.25.pdf

- CCF Flash Report Capital Pres - 11.30.25.pdf

- CCF Flash Report Capital Pres - 10.31.25.pdf

- CCF Flash Report Capital Pres - 09.30.25.pdf

- CCF Flash Report Capital Pres - 08.31.25.pdf

- CCF Flash Report Capital Pres - 07.31.25.pdf

- CCF Flash Report Capital Pres - 06.30.25.pdf

- CCF Flash Report Capital Pres - 05.31.25.pdf

- CCF Flash Report Capital Pres - 04.30.25.pdf

- CCF Flash Report Capital Pres - 03.31.25.pdf

- CCF Flash Report Capital Pres - 02.28.25.pdf

Intermediate Pool

- Time horizon for fund use: 2-7 years

- Investor type: The investor does not have a known use for funds or flexibility in the use of funds and desires a yield better than cash plus inflation with an opportunity for real growth and can tolerate mild volatility

- Risk rating: 3 out of 5 (moderate risk)

Investment Fee: 0.43%

The investment objective is a balance of current income, principal growth, and downside protection. The portfolio invests in fixed-income instruments to generate current income and reduce volatility. It invests in equities to provide capital appreciation and help mitigate the effects of inflation. An allocation to alternative investments will provide diversification and downside protection to the portfolio.

The portfolio is anticipated to have a moderate level of volatility due to fluctuations in interest rates and equity valuations. A modest allocation to alternative investments may help mitigate this volatility.

2025 - 2026 Monthly Flash Reports: Intermediate Pool

- CCF Flash Report Intermediate 1.31.26.pdf

- CCF Flash Report Intermediate - 12.31.25.pdf

- CCF Flash Report Intermediate - 11.30.25.pdf

- CCF Flash Report Intermediate - 10.31.25.pdf

- CCF Flash Report Intermediate - 09.30.25.pdf

- CCF Flash Report Intermediate - 08.31.25.pdf

- CCF Flash Report Intermediate - 07.31.25.pdf

- CCF Flash Report Intermediate - 06.30.25.pdf

- CCF Flash Report Intermediate - 05.31.25.pdf

- CCF Flash Report Intermediate - 04.30.25.pdf

- CCF Flash Report Intermediate - 03.31.25.pdf

- CCF Flash Report Intermediate - 02.28.25.pdf

Growth Pool

- Time horizon for fund use: 7+ years

- Investor type: The investor does not have a known use for funds or flexibility in the use of funds and desires long-term real growth and can tolerate volatility

- Risk rating: 4 out of 5 (moderate to high risk)

- Investment Fee: 0.40%

The investment objective is primarily principal growth with some downside protection. The portfolio's return will be generated mainly through capital gains from equities. Fixed income and a modest allocation to alternative investments are used primarily to reduce volatility and provide downside protection. The risk tolerance for this portfolio is above average. The portfolio is anticipated to have a moderate level of volatility due to fluctuations in interest rates and equity valuations. A modest allocation to alternative investments may help mitigate this volatility.

2025 - 2026 Monthly Flash Reports: Growth Pool

- CCF Flash Report Endowment - 1.31.26.pdf

- CCF Flash Report Endowment - 12.31.25.pdf

- CCF Flash Report Endowment - 11.30.25.pdf

- CCF Flash Report Endowment - 10.31.25.pdf

- CCF Flash Report Endowment - 09.30.25.pdf

- CCF Flash Report Endowment - 08.31.25.pdf

- CCF Flash Report Endowment - 07.31.25.pdf

- CCF Flash Report Endowment - 06.30.25.pdf

- CCF Flash Report Endowment - 05.31.25.pdf

- CCF Flash Report Endowment - 04.30.25.pdf

- CCF Flash Report Endowment - 03.31.25.pdf

- CCF Flash Report Endowment - 02.28.25.pdf

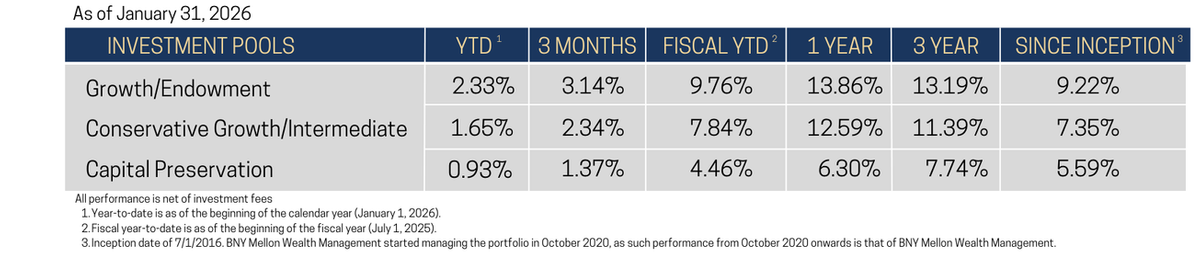

Pool Performance