What is Catholic Values Investing?

Catholic Community Foundation helps steward your money faithfully, ensuring that the investments are consistent with the teachings of the Catholic Church.

Catholic values investing means consciously vetting companies and avoiding investments in those contrary to Catholic teaching, as reflected in their business practices, products, or services. By taking this extra step, the Foundation, its investment partner, management team, and finance and investment committees can assure its donors that this model is at the forefront of our philosophy.

Through our relationship with the global financial services company, BNY Mellon, we have created a menu of four USCCB-compliant* portfolios that are 99% Catholic Values screened. We aim to minimize costs, capture high-quality investments, and provide adequate returns to help your charitable dollars grow tax-free.

*United States Council of Catholic Bishops (USCCB).

What is the difference between socially responsible investing and investing in accordance with the USCCB?

As a Catholic organization, the United States Conference of Bishops (USCCB) draws the values, directions, and criteria that guide its financial choices from the Gospel, universal Church teaching, and Conference statements. The three strategies employed are:

Doing no harm (avoiding evil)

Active corporate participation

Positive strategies (“promoting the common good”)

Our Finance and Investment Committee, along with our management team, is responsible for overseeing the investment manager's activity and holdings to ensure adequate compliance with the Investment Policy Statement. The Investment Policy Statement is a tool that governs the rules, goals, and objectives of the Foundation’s investment practices. Although the investment partner acts as a fiduciary, we layer in additional safeguards to ensure we honor our call to comply with USCCB guidelines.

Our Philosophy

Screening for Catholic Values

We meticulously curate our investment portfolio to align with the ethical guidelines the United States Conference of Catholic Bishops (USCCB) set forth. This involves eliminating companies that engage in activities contrary to the teachings of the Catholic Church.

Proxy Voting

Beyond mere screening, we adopt a proactive stance by participating in corporate resolutions. We aim to influence corporations to align their operations and policies with Catholic teachings. We exercise our voting rights to advocate for change on matters of social concern.

Corporate Engagement

Our commitment to social responsibility extends to active engagement with corporations, including companies within and outside our investment portfolio. We advocate for change in corporate behaviors that violate social norms, such as child labor and human rights, to bring them in line with ethical standards.

In terms of corporate governance, we believe that corporate boards have a significant role in addressing social issues. To that end, we select fund managers who are not just willing but committed to actively communicating with companies. This dialogue helps us better understand how the interests of boards and management align with those of shareholders, especially on critical social issues. Where necessary, we are prepared to take decisive action through our voting rights to ensure that corporate practices meet our ethical standards.

Our Strategy

At the Catholic Community Foundation, our investment philosophy is grounded in an active management approach that leverages the expertise of separately managed accounts (SMAs) to identify the best managers within each asset class. This strategy aims to maximize both our portfolios' Catholicity and returns.

We invest in approximately 800 companies across our portfolios, carefully constructed to achieve the risk profile that best serves our community and its unique needs.

Our long-term approach is consistent with our strategic allocations, while short-term changes result from tactical opportunities identified by the wealth of knowledge from our partners. Unlike traditional index-based strategies, our focus is not merely on low-cost diversification but on improving risk-adjusted returns through active management. Our investment strategy is a blend of science and morals, driven by a commitment to serve our community's financial and spiritual needs. We aim to minimize risk through broad diversification, but unlike traditional index-based portfolios, we actively engage with our holdings and partners to ensure alignment with Catholic values and teachings.

USCCB Guidelines

Protecting Human Life

By excluding investment in companies whose activities involve abortion, contraception, embryonic stem cell research, human cloning, euthanasia, or assisted suicide.

Encouraging access to life-saving drugs and vaccines.

Promoting Human Dignity

By providing sufficient wages and working conditions.

Supporting media and tech companies that generate marriage-affirming and family-oriented content.

By speaking out against pornography, human trafficking, forced labor, and discrimination.

Enhancing the Common Good

Avoid investing in firms primarily in arms production and addictive materials and behaviors.

By improving quantity and quality of life.

Saving Our Global Common Home

By focusing on emission reduction, ecological preservation, renewable energy, and sustainable impact.

Pursing Economic Justice

By implementing corporate social and environmental responsibility guidelines, fair labor practices, and affordable housing. By increasing capital for disadvantaged, underserved individuals and communities.

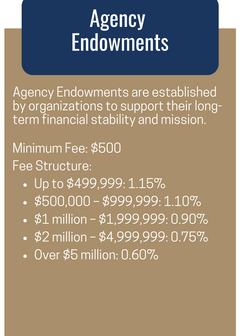

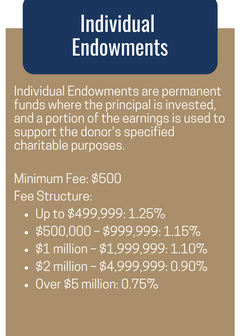

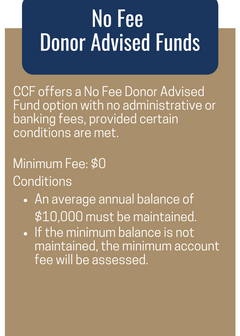

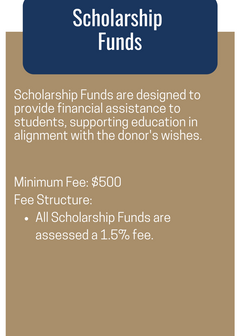

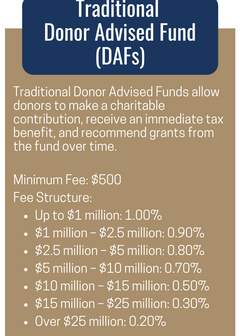

Mission Support Fees and Investment Fees

Our administrative fees, or, as we like to call them, Mission Support Fees, help the Foundation administer its program, which allows us to give back to the causes and missions of other Catholic institutions that impact our community.

The investment fees are direct underlying fees applicable to each investment pool the Foundation offers. Our investment manager directly charges these fees, and the Foundation does not retain them. If you would like more information, you can click here to learn more about the fees applicable to each pool.