Donor-Advised Funds

Giving made easy, efficient, and best yet, aligned with your values

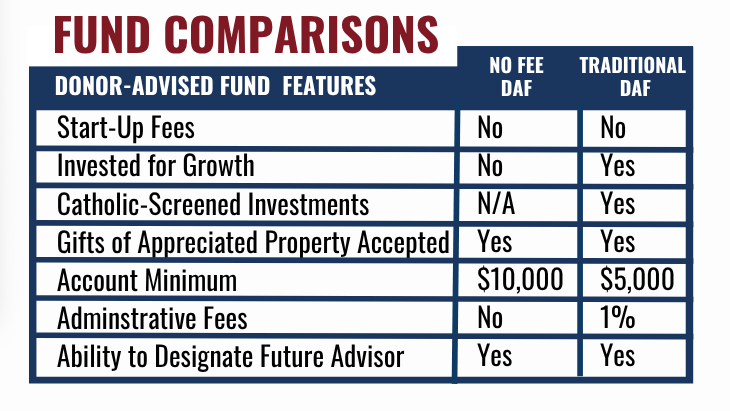

A Donor-Advised Fund (DAF) is a savings account you create to fund your annual charitable giving. These funds provide an effective tax strategy, making your donations eligible for immediate tax advantages. A DAF is one of the most popular charitable giving tools in the United States, and for good reason. This tool provides administrative benefits, tax benefits, and potential tax-free growth, and a unique way to give back to our community in the most Catholic-Christian way possible.

Advantages of giving through a Donor-Advised Fund

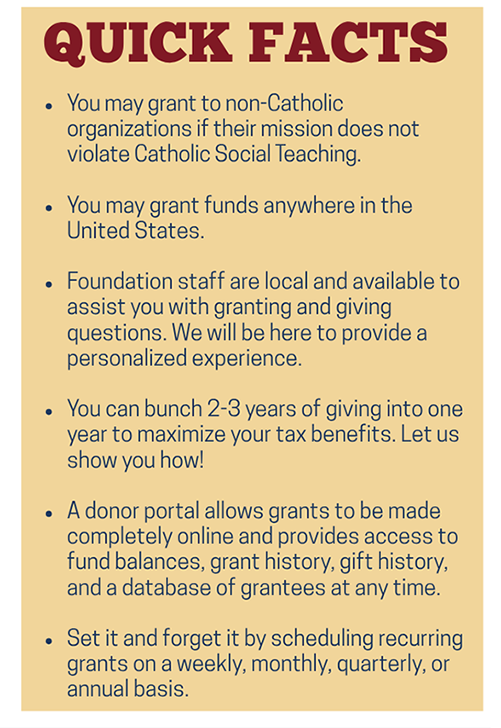

A Donor-Advised Fund (DAF) is a tax-advantaged, convenient vehicle for donating to the organizations you already love and support. You receive the full tax deduction in the year the contribution is made to your DAF, and can decide later where and when to make grants.

Best of all, a DAF through the Catholic Community Foundation aligns your values with your charitable giving, where all funds are invested in 99% Catholic values investment pools. If applicable, any administration fees from your DAF are used to benefit our community through scholarships, grants, and sponsorships.

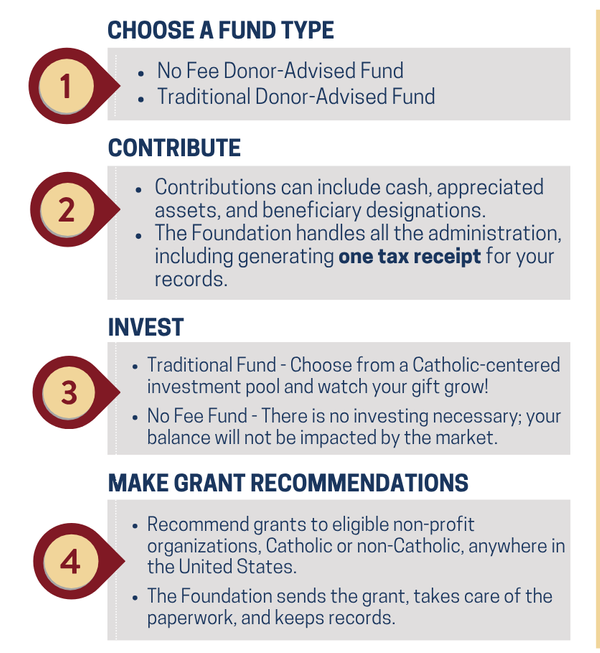

How to begin

testimonial

Benefits of a Donor-Advised Fund

tax benefits today

Enjoy the tax benefits as soon as you make your first gift. Later, you can decide where the money will be granted. You can feel secure knowing the tax-free growth will continue from our carefully vetted Catholic-values investment pools.

Personal administrator

Take a few charitable giving items off your to-do list. We’ll keep the records, send the checks, send you receipts, and, most importantly, ensure that all decisions uphold your values - forever!

expert advisors

Learn how to use appreciated assets to maximize your giving and minimize your taxes through charitable bunching and other complex giving strategies.

full-service solutions

Coordinate your charitable giving through the Foundation: schedule recurring tithing or grants to one or multiple organizations. Get to know our team, and know we are only a phone call away. You can trust us to answer our phones!

Catholic Investments, Tax-free growth

Get all of the benefits of a private foundation in a donor-advised fund, without the regulatory and accounting requirements, no required annual disbursement percentage, no complexity, and no setup costs. Like a private foundation, a donor-advised fund can be passed along to future fund advisors to manage and oversee.

Private Foundation

Get all of the benefits of a private foundation in a donor-advised fund, without the regulatory and accounting requirements, no required annual disbursement percentage, no complexity, and no setup costs. Like a private foundation, a donor-advised fund can be passed along to future fund advisors to manage and oversee.

Why Choose the Catholic Community Foundation?

Trusted Stewardship

With over 40 years of experience, we are a trusted partner for Catholic philanthropy, ensuring your intentions are honored.

Values-Based Investing

Your funds are managed ethically and in alignment with Catholic social teachings.

Community Impact

Your giving directly supports the growth and stability of Catholic schools, parishes, ministries, and other vital programs.